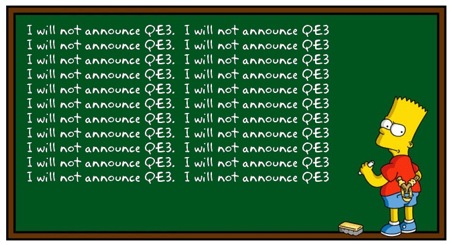

David Einhorn, President of Greenlight Capital, has published a brilliant article exposing why the Fed's policies are counter-productive to economic recovery, because they don't produce the effects intended. (H/T WC Varones) Although, he doesn't explicitly say so in the article, I believe he is also making a good case for the gold standard, because only a gold standard would prevent the Federal Reserve from playing these kinds of games with the economy. It's difficult to do justice to an article of that length, but I wanted to give my readers a sense of the magnitude of the folly of Chairman Bernanke.

David Einhorn, President of Greenlight Capital, has published a brilliant article exposing why the Fed's policies are counter-productive to economic recovery, because they don't produce the effects intended. (H/T WC Varones) Although, he doesn't explicitly say so in the article, I believe he is also making a good case for the gold standard, because only a gold standard would prevent the Federal Reserve from playing these kinds of games with the economy. It's difficult to do justice to an article of that length, but I wanted to give my readers a sense of the magnitude of the folly of Chairman Bernanke.The fed is keeping interest rates low and is signalling that they will keep rates low for a long time. Both facts are impacting markets. Einhorn likens this to a steady of diet of Jelly Donuts, on the analogy that a single jelly donut might give you a boost of energy in the afternoon, but a steady diet of them just makes you sick. What are the impacts of artificially low interest rates?

- Low interest rates make it harder for retirement eligible to actually retire, they are getting little return for their money.

- Interest rates are a measure of the time value of money. By setting it at zero, there is no urgency about investment decisions.

- Because those who live on fixed savings, have less to spend, they spend less, harming the economic recovery.

- Investment isn't increasing at zero rates, because once rates fall below the rate of inflation, the only consideration is whether the principle can be paid back. If inflation is at 2.5%, then reducing interest rates from 2.5% to 1.5% or even zero percent will have no effect on investment, so there is no offset to the fact that savers have less to spend.

- Zero rates allow otherwise worthless loans to appear to be performing, as the borrower can make nominal payments. But it delays the necessary economic unwinding necessary for real economic recovery.

And what about signalling that interest rates will stay low for a long time?

- Bonds, even though they are paying a paltry 2%, have no downside risk, because investors know that there is no danger of rising rates.

- This does the stock market no good, because only the rich are investing. Note the thin volumes on the market, making it more volatile. Further, the policy allows the rich to leverage assets with access to cheap capital at the expense of the middle class, increasing income inequality. (I don't believe that income inequality per se, is bad; but when it derives from government favoritism in the banking system or policy, it rends the social fabric due to its fundamental unfairness.)

- Inflation is taking hold in commodity markets, especially oil and gold. Inflation seldom shows up evenly in the economy. Gold and oil prices seem to reflect belief that the fed is pumping ever greater numbers of dollars into the economy. But higher oil prices retard economic recovery.

Einhorn ends the article with a plea for a modest increase in interest rates. I disagree. We can't expect politically appointed and connected Federal Reserve board members to pursue such a policy. It would send a shock to the Treasury in the form of massive increases in the burden of servicing the debt. Better to remove the power of the fed to artificially set interest rates by returning to a gold standard. People may argue that we had boom and bust cycles under the gold standard. My question, "Is this economy any better?"

Wow! Too many issues in one post. Where to begin. The gold standard is an interesting argument. Too bad DeGaulle ruined it. The argument that low rates are hurting the economy looks good, but on analysis doesn't hold water. More accurately, the Fed has had to keep rates low to allow time for politicians to act. I could go on awhile, but my main issue is the idea that low rates deprive retirees, etc. Of income which could help the economy. There are plenty of income producing investments available to generate the required income. Those bemoaning low rates have bought in tithe idea that our retirees should only invest in short term debt instruments "guaranteed" by our all knowing government. There is too much fundamental underlying ideology in the assumptions of the argument. Unfortunately, there is enough logic to make it sound good.

ReplyDeleteI think I would have used "anonymous" too. Your criticisms are ridiculous. Low rates DO deprive seniors of income. Their savings is in money markets, CD's and such. The idea that they can get more from other income producing is meaningless as it is a fact where their savings actually is, not where it could be. Also that safe short term investment yielding higher rates is easy denies the any efficiency of the market. Any higher income investment entails more risk. Period. Statistics prove that seniors are indeed getting hurt by below inflation returns. Likewise the idea that the Fed is keeping interest rates low to "allow politicians to act", just discredits your coment more. BTW, even Fed heads like Thomas Hoenig and Richard Fischer have publicly said that seniors and savers are getting hurt.

DeleteAnonymous, thanks for commenting. It doesn't matter what retirees should or shouldn't do, the fact is they are risk averse. As to ideology, it is only my own, not Einhorn's. I think Einhorn fairly analyzes the facts with an eye towards increasing his clients overall wealth, which leads him to hedge with gold. My ideology makes the leap to the gold standard. I assume that you believe in free markets. Free markets would mean interest rates are free to rise and fall as well, in the most efficient economic system. Instead, we get political manipulation of interest rates, to no good end. When interest rates rise to the point that we can't service the national debt, you might come to a different conclusion.

ReplyDeleteActually, Einhorn left out a few facts, such as marginal consumption being largely unaffected by interest rates. I also have no doubt that interest rates should be higher and, based on current policies, inflation will be a problem in the near future. The Fed has said as much, openly. Unfortunately, the Fed's political, full employment mandate is hamstringing policy. Einhorn is blaming the Fed. I blame Confessional/national inability to address the budget through structural reform. Somehow, we need effectively limit our government's ability to borrow.

ReplyDelete