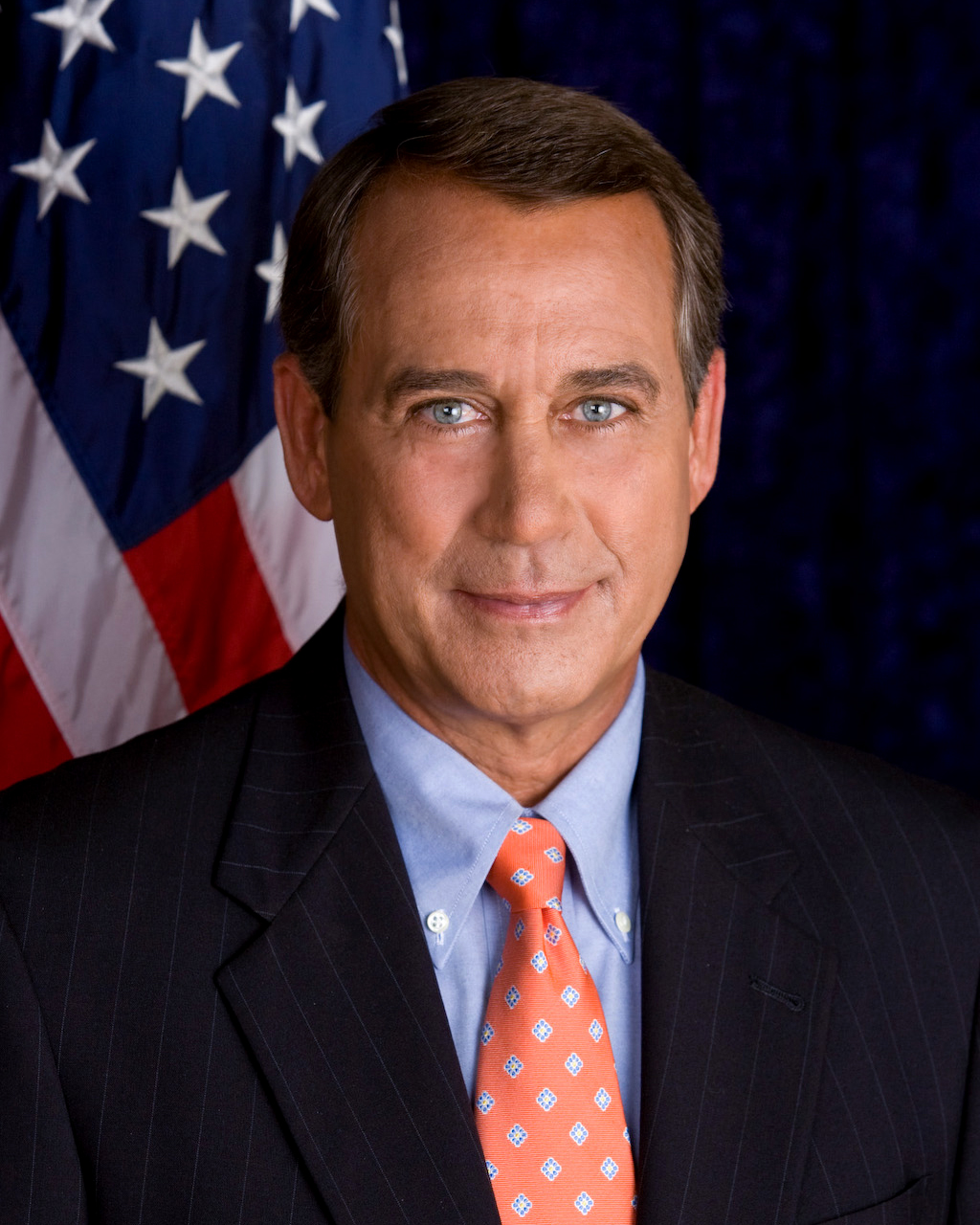

I reviewed a summary of tax law changes at Yahoo Finance. The bad news is that the top rate increases from 35% to 39.6%, but that is not even that bad of news. It affects married filers with income over $450,000, and frankly they will find ways to avoid that tax. That group's capital gains rate will increase to 23.8% (20% + 3.8% for mediscarce). Meanwhile, 99% of the Bush tax cuts are made permanent. The payroll tax was restored to its historic rate of 6.2%, from the useless and temporary cut to 4.2%. This will slow the hemorrhaging in the Social Security account and ensure that lower income Americans are also paying taxes. Best of all, the indexing for alternative minimum tax was made permanent and little was changed in the gift and estate tax rules. Benko wrote that Boehner scored a huge victory, because the tax deal deprives Obama and the Democrats of the revenue to fund their agenda.

Enter sequestration. Since the Democrats have expended their ammo by cutting the tax deal and "taxing the rich," there is little revenue for them to offer for deficit reduction. The administration deliberately prevented the Defense Department from planning for sequestration at the start of this fiscal year, thinking the Republicans would blink. They have not. The cuts imposed are going to be very painful in the short term, but that's only because Obama's lack of leadership are forcing a 10% across the board cut to be executed in the second half of the fiscal year, making it look like a 20% cut, for the time being. But some of the problems with military spending have little to do with readiness. Retiree health care costs now consume 10% of the military budget, $59 billion, up from $20 billion only a decade ago. Military pay raises have outpaced inflation over the same period. In the decade ending in 2009, military pay had grown 52%, while civilian wage inflation over the same period was 38%. The other big headache is that the military operation are heavy users of petroleum based fuels. Operations and maintenance is the biggest defense budget category and the high price of fuel contributes. In my opinion, reducing training tempo, deferring maintenance and releasing soldiers and sailors is where they will find the big money to pay for the cuts.

So the Republicans believe that they can live with defense cuts, while other programs favored by the Democrats also get axed. Defense spending was overdue for a pullback, the country does so after every wartime period.

Of course, none of this deals with the real fiscal threats, social security, mediscarce and medicaid. Looking at the graph below, if you count interest on the national debt as a transfer payment, then transfer payments, mostly from the young to the old, consume 60% of the federal budget:

If we don't get those under control, squabbling over the other 40% won't really make much of a difference.

Yay! Sequestration! Ham-handed, illogical budget cuts! Boy, is this going to be fun.

ReplyDeleteMy favorite part is the total elimination of fleet maintenance in Q3 and Q4. Woot.